Drax sustains its biomass hopes with carbon capture push

Drax’s biomass terminals have been at the centre of controversy in the UK’s push to reach net zero and bolster energy security, with sustained scrutiny over the power group’s environmental bona-fides.

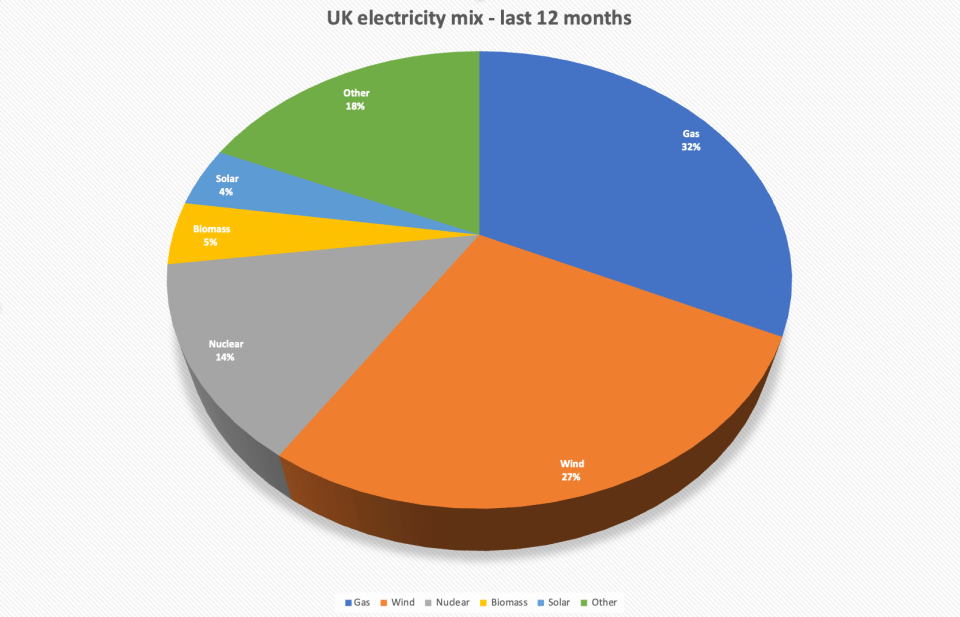

Biomass – which involves the burning of wood pellets to generate power – currently makes up 12 per cent of the UK’s renewable mix.

The vast majority of this is generated at Drax’s power station in Selby, North Yorkshire, whose four biomass terminals were highly valuable in the government’s scramble to keep the lights on and homes warm last winter amid a Russian supply squeeze on the continent.

At optimum generation in high-efficiency wood pellet stoves and boilers, biomass pellets can offer combustion efficiency as high as 85 per cent – making it highly prolific as an energy source.

However, recapturing carbon from wood pellets takes decades and the off-setting is only substantial with younger, less carbon-rich trees.

Biomass made up five per cent of the electricity mix over the past 12 months (Source: grid.iamkate.com)

This matters when there are high emissions of carbon dioxide per unit of energy, with Ember calculating that the company’s power station is the largest emitter in the country – as Drax imports supplies from overseas.

Drax has also been accused by Bloomberg of effectively gaming the system for one of its four terminals and of using mature trees in Canada for its wood pellets by the BBC – both claims it denies.

Meanwhile, the company is contending with a rocky share price, which has tumbled this year amid multiple shorting attempts.

Under such scrutiny, the government’s biomass strategy – unveiled in August – was a welcome boost for the firm.

It backed the continued use of the energy source, provided it was combined with schemes to minimise carbon emissions through capturing them at generation.

The reprieve eases pressure on Drax, which was facing the challenge of the current vast subsidy arrangements for biomass coming to an end in 2027, and potentially paves the way for its own biomass emissions carbon capture strategy – known as BECCS.

Drax has endured a torrid time on the FTSE 250 this year (Source: London Stock Exchange)

Drax pushes BECCS project to meet green goals

Drax’s BECCS proposal has so far missed out on approval through the ‘track one’ and “track two’ processes outlined by the government – which is prepared to commit up to £20bn in funding to projects across the country.

Downing Street has established two clusters for projects – the East coast cluster focusing on the Humber region and the Hynet cluster in the Irish Sea.

The government is targeting the capture and storage of 20m-30m tonnes of CO2 per year by 2030 and over 50m tonnes per year by 2035.

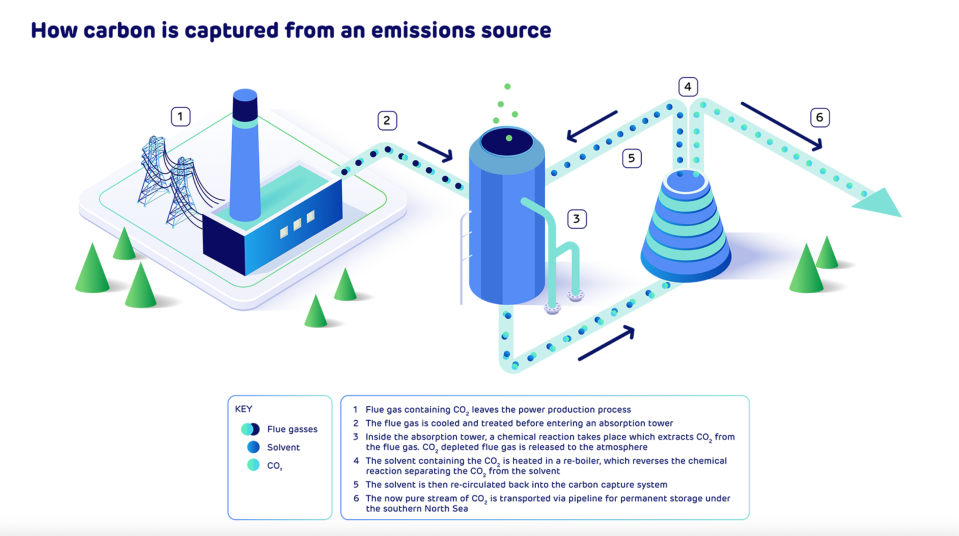

Drax hopes its proposed £2bn project which would capture carbon from its facilities and transport them into storage under the seabed in the North Sea would capture as much 8m tonnes by the end of the decade – if approved by government and regulators.

However, it missed out on initial approval from the government and was not included in the first eight projects greenlit for negotiations in July, with BP instead the big winners with three projects approved.

Richard Gwilliam, UK BECCS programme director at Drax, told City A.M. that while Drax’s project met the government’s deliverability criteria, “the challenge was availability of transport or storage infrastructure” in the Humber region – where no projects were initially picked.

“I don’t think the government was necessarily ready for that sort of project to come online. It’s taken them time to get a viable strategy together – and to announce a subsequent phase of the competition – for them to have really contemplated the scale of BECCS,” he said.

Drax’s biomass carbon capture strategy explained (Source: Drax)

However, the Humber-based Viking project overseen by Harbour and BP was later shortlisted, while Drax’s own ambitions have still not progressed.

But Drax are optimistic, with the Department for Energy Security and Net Zero (DESNZ) confirming last month that large-scale power BECCS is now viable for the track one process.

This could lead to future shortlisted projects holding negotiations with the government next autumn – a potential pathway for Drax.

Environmental think tank Green Alliance has a more critical view of biomass’ continued operations – and the government’s support for future subsidies.

Policy director Dustin Benton told City A.M. that advocates of bioenergy with carbon capture and storage are failing to “make a compelling case for public subsidy, because the UK has abundant renewable energy, and hydrogen could prove a valuable form of long-term energy storage when renewables aren’t available”.

He said: “BECCs plants like Drax would be useful but aren’t critical to the UK’s power supply – so does subsidising them divert resources from building more renewables or energy storage to stabilise the grid? Meanwhile, given we don’t have adequate international standards for ensuring biomass is truly sustainable, we don’t know for sure whether it’s better to leave forests alone to sequester carbon.”

Drax is not looking for direct taxpayer support for its BECCS plans, but instead is hoping for guarantees of a bridging mechanism for its legacy generators.

This would mean revenues would be secured as they were upgraded – with two of the company’s four terminals initially proposed for the BECCS process.

“The way that the government are contemplating structuring a deal for BECCS would effectively lead to us having a dual contracts for difference, so it has a strike price for power and a strike price for carbon,” Gwilliam explained.

He revealed Drax was still mulling over the conversion process for its other two biomass units, depending on the cost implications.

Biomass remains under scrutiny

Although Drax’s position has been bolstered by the government’s biomass strategy and eligibility, there are still challenges ahead for the FTSE 250 company.

For instance, the National Audit Office is putting the biomass strategy under the microscope in its own investigation, evaluating its credibility in the push to net zero.

Meanwhile, Ofgem is still assessing whether Drax is in breach of annual profiling reporting requirements for its renewable obligation scheme.

Gwilliam was bullish over the viability of BECCS in the midst of potential challenges from regulators.

“Transparency is something that I think the industry has to welcome. I don’t expect that the outputs of the National Audit Office will affect this appetite to deploy BECCS at scale in the UK,” he said.

Achieving our carbon budgets is already extremely challenging; pathways to do so like that of the Climate Change Committee invariably include a large BECCS facility very similar to the Selby plant coming online by 2030…

Adam Bell, head of policy, Stonehaven

Adam Bell, ex-head of energy at BEIS and now head of policy at Stonehaven, told City A.M. the government’s continued support for biomass reflected increasingly stringent pathways to net zero.

Carbon budgets are tightening, with the government needing to find new ways to contain emissions – making Drax’s BECCS project highly appealing to Downing Street.

He said: “Achieving our carbon budgets is already extremely challenging; pathways to do so like that of the Climate Change Committee invariably include a large BECCS facility very similar to the Selby plant coming online by 2030. Taking this option off the table would make government’s job even harder.”

A DESNZ spokesperson said: “When used carefully, sustainable biomass is a versatile resource and a potential alternative to fossil fuels for power, heating and transport.

“Our new strategy sets out the role this can play in multiple UK sectors, such as industry and aviation, and alongside carbon capture and storage, it will help cut emissions while creating jobs, growing the economy and strengthening Britain’s energy security.

As Drax pushes its BECCS project the debate over biomass will continue to rage on, with the possibility that the energy source will be maintained as the government scrambles to reach its climate commitments.