| Updated:

City fines hit record high as watchdog cleans up

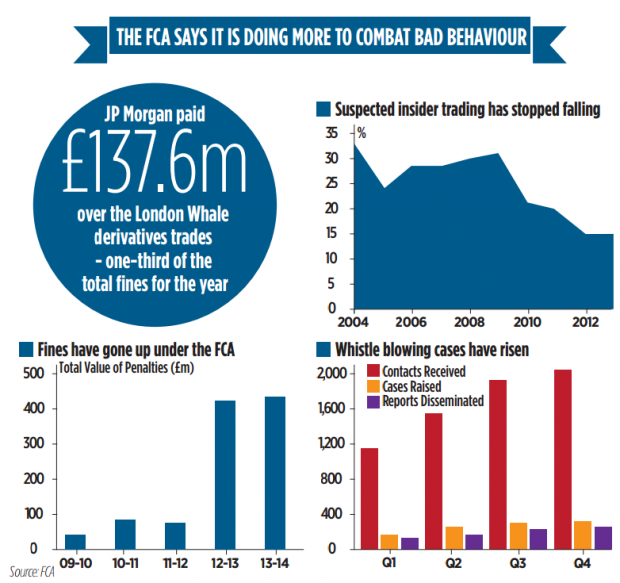

The City watchdog’s fines came in at nearly half a billion pounds last year, the Financial Conduct Authority’s annual report showed yesterday.

But despite the crackdown on bad behaviour, the downward trend in suspected insider trading came to an end, with suspicious market activity edging up on the year.

The watchdog also warned it is having trouble hiring and keeping high quality staff, and needs to work harder to reduce worker turnover.

The FCA brought in £425m in the year – a record high, and almost as high as the watchdog’s £435.4m income from fees from the industry.

More than one-third of the fines came from JP Morgan with a £137.6m charge over the London Whale derivatives trading incident.

But despite the hike in fines, the improvement in market cleanliness over recent years suddenly ground to a halt in 2013.

The FCA’s report showed that in 2009 around 30 per cent of market-moving announcements were preceded by substantial share price movements. By 2012 that had fallen to 15 per cent – but the decline stopped, with the figure still at 15.1 per cent last year.

And the FCA said it is finding it is also struggling with its workforce.

“Our success is built on the experience and expertise of our people,” said CEO Martin Wheatley. “To ensure we continue to attract and retain the best and brightest we have significantly invested in our people, initiating a number of new programmes to develop and further our staff.”