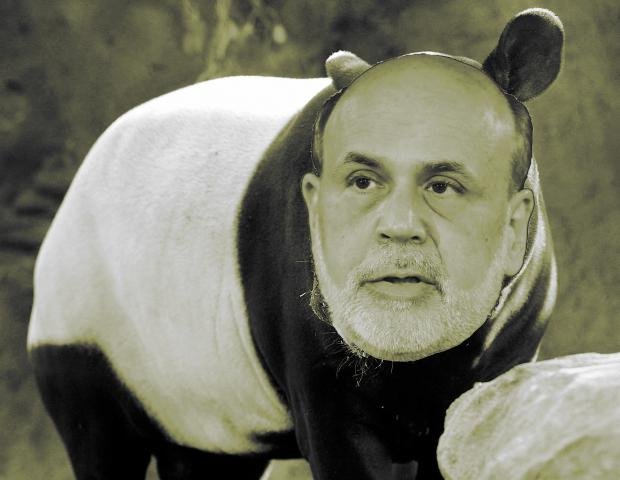

Bernanke’s legacy: The long-nosed Malayan tapir

Ben Bernanke, governor of the Federal Reserve, will soon be leaving his role – amid investor and economist focus on how and when the Fed will taper.

Tapering – or a reduction in the rate of expansion of the monetary base – was expected this month. Market watchers had been forecasting the announcement since June 2007.

We suggest that having upset market expectations and postponed tapering, that Bernanke is most accurately describe as the Malayan tapir – the longest nosed of the tapir family.

Long of nose – and slow to act – The Bernankir is a controversial figure.

Fed does what it said it would do—make its decisions based on the data. Good for them, and good for policy credibility.

I’m convinced that the costs of QE and very low rates are now unambiguously larger than their benefits.

…

One of the great costs of our current monetary policy consensus is that it has robbed stock, bond and many other prices of much of their informational value. They no longer properly reflect the decisions and tastes of millions of individuals, or the relative scarcity of goods, services and capital.

[Bond yields show] we have moved out of the “expectational trap”. Investors no longer see weak nominal GDP growth as a permanent situation.

My concern is not that monetary policy is too tight in the US. My concern is that monetary policy still is far too discretionary.