Scottish independence: Uncertainty over the referendum could dampen UK house price growth

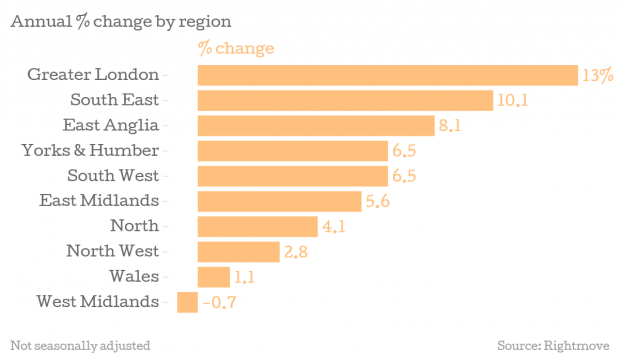

House prices across England and Wales were up 7.9 per cent over the last 12 months, according to data from Rightmove.

The company, which surveys a sample accounting for 90 per cent of estate agents, does not seasonally adjust its figures and so one-off monthly trends are difficult to analyse.

Nevertheless, the 0.9 per cent increase in average asking prices over the last month sees the first rise at this time of year since 2011.

One thing that could dampen the mood in the housing market is the Scottish independence referendum.

Uncertainty never plays well with markets – so Rightmove director and housing market analyst Miles Shipside was apprehensive:

Even the very debate around Scottish independence and possible implications for the economic outlook for the rest of the UK could cause uncertainty in the minds of potential home-movers contemplating a large long-term financial commitment.

We usually see a price fall at this time of year as potential home-movers are generally still in holiday mode. However, it looks like there are early signs of abounce-back in demand after the summer lull.