London listing to raise $2.1bn for AngloGold

SOUTH African mining giant AngloGold Ashanti yesterday announced plans to raise $2.1bn (£1.3bn) in a rights issue and spin its international assets into a new London-listed company.

The Johannesburg-based mining firm, created by a merger between AngloGold and Ashanti in 2004, revealed it would focus on its core South African operations after the asset spin off.

AngloGold chairman Sipho Pityana said: “It has become increasingly clear that the two distinct parts of our portfolio require different strategies, focused management and should be appropriately capitalised to realise their full potential”

The new company will be led by prospective chief executive Charles Carter, as AngloGold also said it would intially keep a 65 per cent controlling interest of the new company.

Analysts at Investec suggested yesterday the new company could be worth around £3bn.

The mining sector has seen a range of demergers and restructurings recently, as last month giant mining firm BHP Billiton also announced it would spin off assets into a new company.

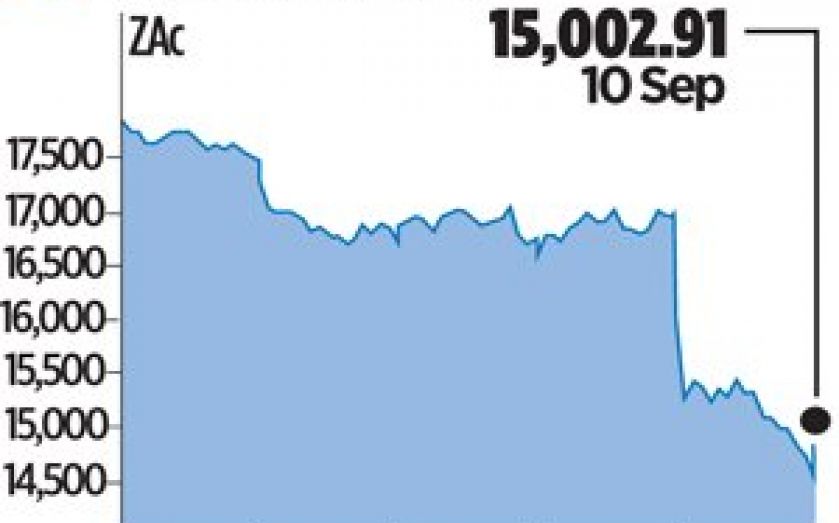

A decline in commodity prices including gold in recent years has hit the profits of many mining companies, with AngloGold suffering a $2.2bn net loss last year.

Mining operations in South Africa have also been badly affected by serious industrial action in recent years, with a five month strike this year hitting platinum production until a settlement was reached in June.