Revealed: Tesco and Metro are the worst challenger banks, according to customers

Tesco Bank and Metro Bank are the worst challenger banks in the eyes of consumers, a new sentiment index has revealed.

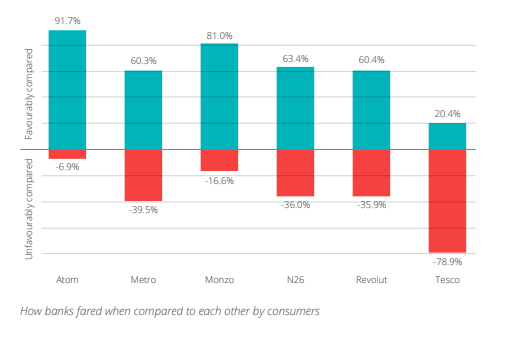

A new report into the sentiment of UK challenger banks by data firm Brands Eye found that Monzo and Atom Bank led the way.

Read more: Tesco Bank slapped with £16.4m fine for data breach

The pair were the only banks to receive more praise than complaints in an analysis of around 120,000 tweets about Metro Bank, Atom Bank, Monzo, N26, Revolut and Tesco Bank.

The index painted a bleak picture for Tesco Bank with 6.3 per cent threatening to leave the bank and a net sentiment score of -40 per cent.

| Banks | Negative | Positive | Net sentiment |

| Monzo | -13 per cent | 44.6 per cent | 31.6 per cent |

| Atom | -2 per cent | 31.3 per cent | 29.3 per cent |

| N26 | -27.1 per cent | 24.4. per cent | -2.7 per cent |

| Revolut | -30.5 per cent | 25.2 per cent | -5.3 per cent |

| Metro | -35.4 per cent | 18.3 per cent | -17.1 per cent |

| Tesco | -53 per cent | 12.8 per cent | -40.2 per cent |

Issues over the turnaround time for complaints fuelled the most discontent and was the key reason customers threatened to leave.

Revolut and N26 were heavily criticised over turnaround time, more than the industry average.

Metro Bank had the second worst sentiment score over a period, which saw it report a loans blunder, two regulatory investigations and suffer a sharp fall in share price.

Public sentiment fell as a result of a tumultuous few months but the index found it did not prompt customers to consider leaving.

But consumers praised Metro Bank’s branches following a number a branch openings amid industry-wide closures.

A Metro Bank spokesperson said: "Customer service is a fundamental priority for the bank and we were delighted that Metro Bank was ranked number one in the Competition and Market Authority’s (CMA) latest Service Quality Survey among personal current account holders for its overall service."

Brands Eye chief executive Jean Pierre Kloppers said banks could not afford to ignore social media in monitoring customer sentiment.

Read more: Metro Bank CEO's pay almost halves after loans blunder

He said: “Banks that capitalise on this, and continue to innovate with new streams of customer data, will build loyalty and reduce churn.

“Those who do not, put both their reputation and bottom line at risk.”