Electric cars to charge ahead

In late July, the UK government announced plans to ban the sale of new petrol and diesel-only cars in Britain from 2040[1].

It joined the Netherlands, Norway, India, and France to become the fifth country to commit to ending the sale of traditional internal combustion engine cars.

However, while it has yet to commit to an all-electric transport program, China leads the world in the field.

In 2016, the country registered 350,000 electric vehicles, more than twice as many as the US. It has 150,000 charging stations with a further 100,000 coming this year. This will leave China with ten times as many charging stations as the US.

The US’ step back from Federal climate commitments may open the door for China to seize opportunities US businesses may be more likely to leave on the table.

The Chinese five-year plan outlined the country’s ambitions by announcing plans to build a nationwide charging network, wide enough to support the demands of five million electric vehicles, by 2020.

More recently, the country reaffirmed its commitment to decarbonisation after the US announced its withdrawal from the Paris Agreement.

Individual US states appear to see opportunity in the challenges. In June, California agreed an alliance with China to develop zero-emission vehicle technologies.

The working group formed in that agreement stems from a partnership established in 2014 between UC Davis Institute of Transportation Studies and the China Automotive Technology and Research Center.

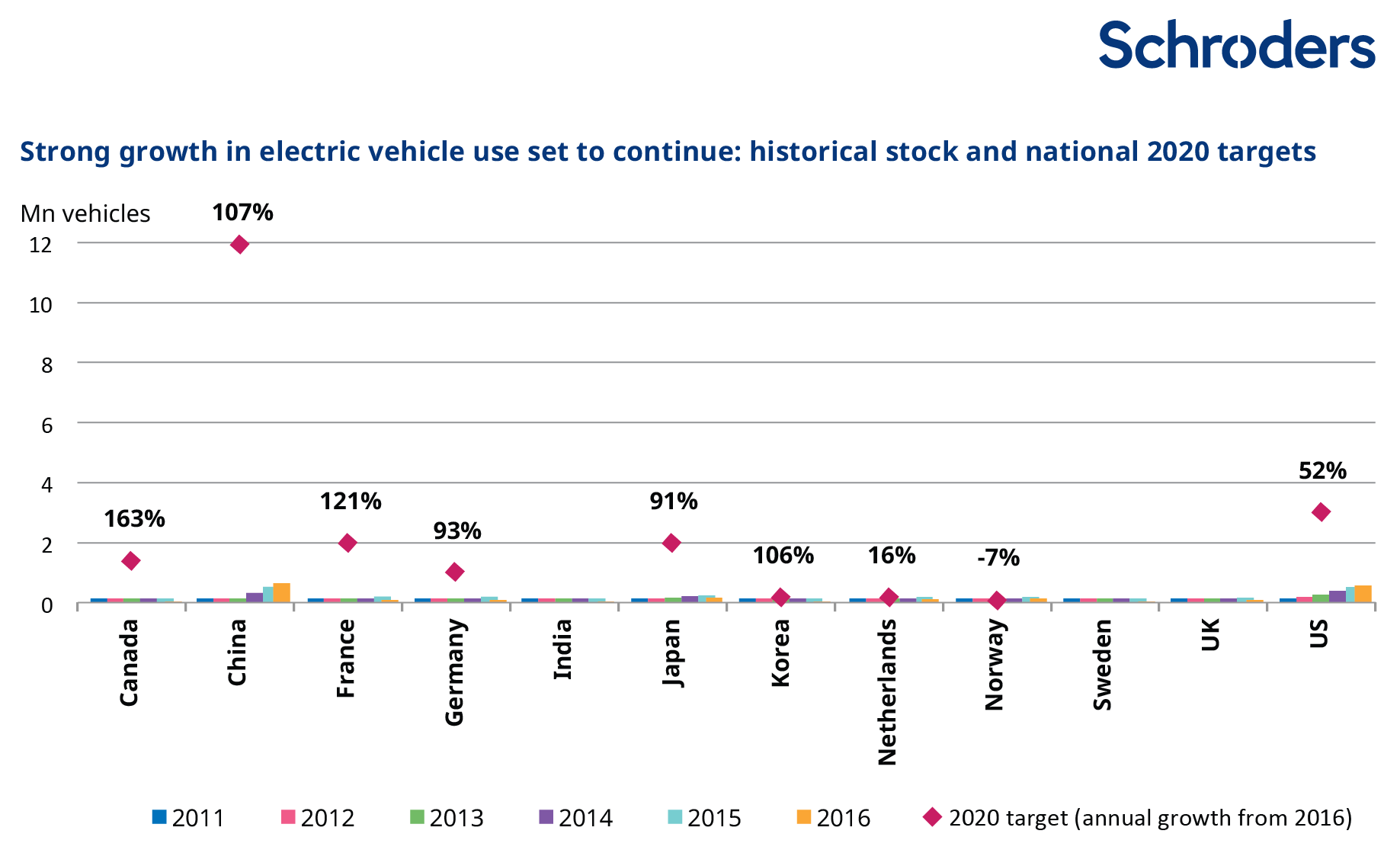

Electric car development is not limited to the US and China, although those markets dominate the global market. The chart below plots the stock of electric vehicles in major markets, along with 2020 national growth targets.

Collectively, those targets imply annual growth of 86% in sales through 2020, just below the 100% annual growth registered over the last five years.

Source: National media, McKinsey[2], IEA, Schroders

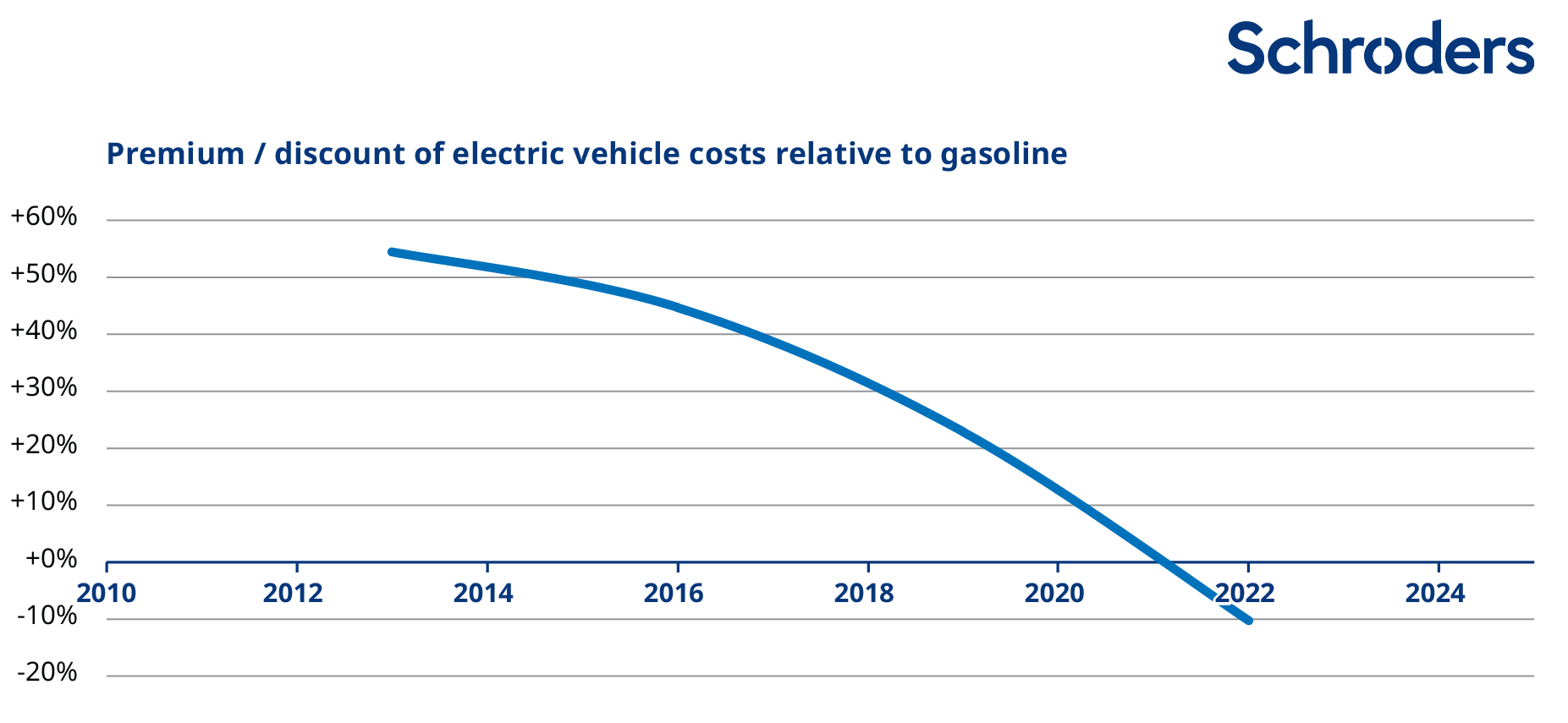

While the rates of growth implied are spectacular, growth is supported by fast improving economics.

In many countries, attractive subsidies already make electric vehicles competitive with gasoline or diesel cars. Unsubsidised costs of ownership (the total cost to consumers over the vehicle life) looks likely to drop below traditional cars in the next few years, if they have not already done so.

Source: IEA, Schroders

The speed of change in the industry has not gone unnoticed by carmakers. The growing number of countries planning to phase out internal combustion engine vehicles effectively deters consumers from buying technology set to be redundant soon.

Many large manufacturers have therefore set aggressive targets.

Volvo has announced its plan to cease production of all gasoline or diesel cars. Larger competitors BMW, GM, Daimler, Ford, Honda, Renault and Volkswagen have all set targets that will require an effective focus on electric powertrain technologies in their product development plans and product launches.

The car industry looks set to be fundamentally reshaped within the next decade, as resources are pulled from traditional gasoline and diesel technologies and redirected toward electric alternatives.

1. https://www.ft.com/content/7e61d3ae-718e-11e7-93ff-99f383b09ff9↩

2. https://www.iea.org/publications/freepublications/publication/GlobalEVOutlook2017.pdf↩

- The Schroders Sustainability Investment Team focuses on identifying sustainably managed businesses, understanding the risks and opportunities of environmental and social change, and actively engaging to improve companies behaviours and governance. Highlights of the team's research is published at schroders.com/sustainability or click here for the full archive.

Important Information: The views and opinions contained herein are those of Andrew Howard, head of sustainable research, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 31 Gresham Street, London EC2V 7QA. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.