Consumer borrowing growth hits decade-high

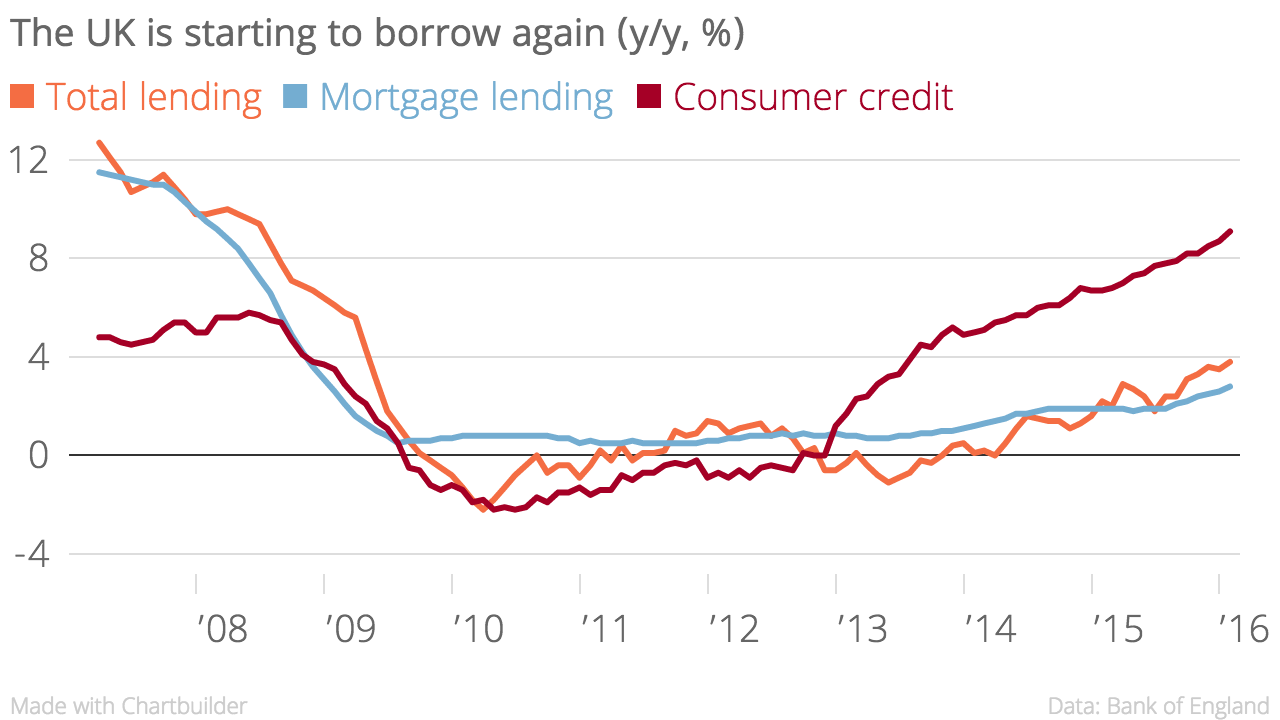

Borrowing on credit cards and through overdrafts is growing at its fastest rate since January 2006, data published today by the Bank of England reveals.

The stock of consumer credit reached £179.5bn in January, up 9.1 per cent on the same month last year.

Total credit growth in the UK is now at its highest rate since 2009, with the figure also being boosted by a recovery in mortgage lending. Lending grew 3.8 per cent from January 2015 to January 2016. The total UK stock of credit is now £1.802 trillion.

"Bank of England Governor Mark Carney has stated that UK growth is not reliant on growing debt levels among households, and it is true that household debt levels have come down from the peak levels seen in 2009. Furthermore, household wealth levels have picked up," said economist Howard Archer from analysts IHS.

"Nevertheless, it is important that consumers do not become increasingly tempted to take on excessive debt and also that bank lending standards do not slip."