London’s prime rental property prices have grown 22.2 per cent since Lehman Brothers: Faster than New York, Hong Kong and Singapore

London's prime rental properties have gone up 22.2 per cent since the Lehman Brother's collapse of September 2008: faster than New York (15.4 per cent) while avoiding the falls seen by other cities such as Hong Kong (-14.4 per cent) and Moscow (-14.9 per cent).

But despite this growth, prime rents in the capital have actually fallen this year, by 0.4 per cent.

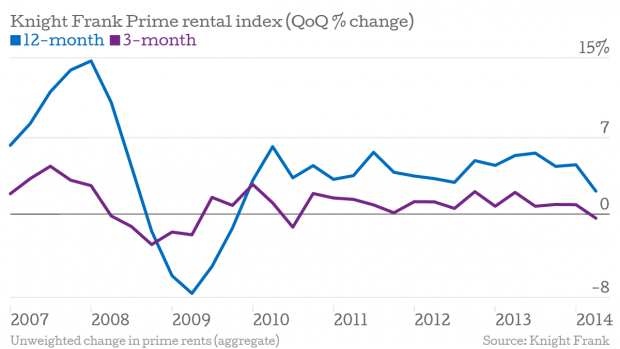

Slowing growth (as opposed to falling prices) is the trend according to Knight Frank, which compiles the prime rent index. Across the list of 17 cities, annual growth was down from 4.7 per cent in the year to March to 2.2 per cent in the year to the end of June.

Over the last three months, the index actually fell.

London's case is an interesting one. The city's growth was higher in the short than the long term: in the 12 months to June prime rents were down 0.l4 per cent; while in the first six months of the year they were up 1.6 per cent. The three-month figure showed the growth is edging back down to an increase of 1.5 per cent .

From the report again:

Prime rents in London began their recovery at the start of the year and recorded monthly growth of 0.9 per cent in June, a three-year record.With interest rates likely to rise in the US and UK in 2015, economic growth largely stagnant in Europe and stringent cooling measures still in place across much of Asia, we expect prime rental markets will benefit from quieter activity in the world’s luxury sales markets during the remainder of 2014.

As the graph shows change rather than actual prices, it gives us an idea of how prime rental estate prices are moving. Dubai, despite topping the list, has slowed from 16.4 per cent to 14.1.

From the report:

In Dubai, prime rents continue to outpace wage inflation which is raising concerns about affordability, leading some to consider buying instead of renting.

In Nairobi, asking rents for key tenants such as the diplomatic community look to have reached their ceiling. This, combined with security concerns help explain the slowing pace of growth.