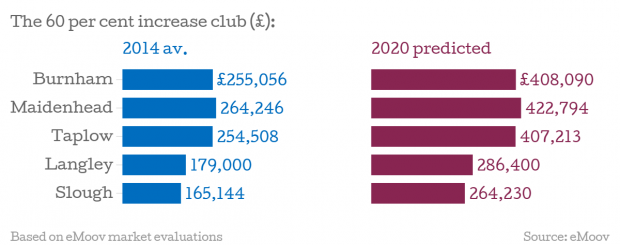

Crossrail will send London property prices soaring by 60 per cent

Houses in the same postcode as Crossrail stops in Burnham, Maidenhead, Taplow, Langley and Slough will jump 60 per cent in value, with prices expected to increase by up to £160,000 in the next four years.

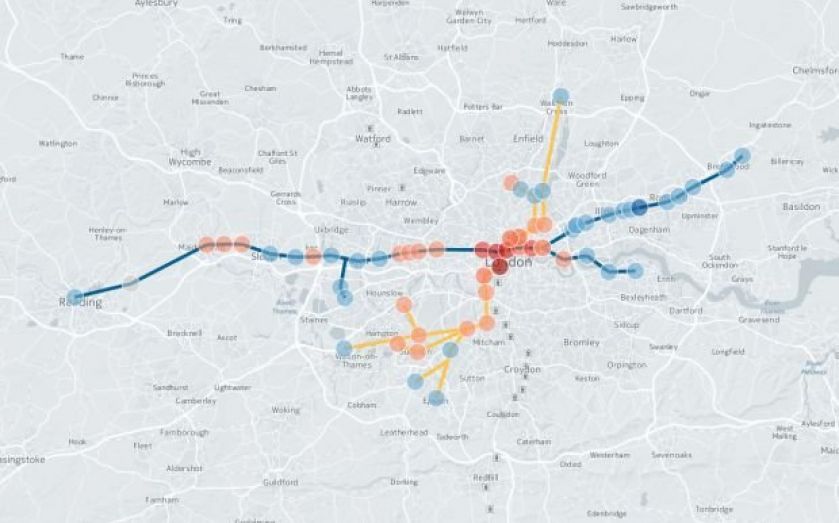

For those on the hunt for a profitable investment, house prices on the opposite end of the Crossrail route, in north and south-east London, will be the most affordable in 2020.

Properties near the Southall, Chadwell Heath, Woolwich, Romford and Shenfield stations will be the best for those looking for an affordable property with a high-speed rail network on its doorstep.

eMoov also calculated the expected price rise over the next four years for properties based on the proposed Crossrail 2 route, which would not be completed until 2030 should it go ahead.

Properties on the proposed route will rise by a median average of 74 per cent in 2020, and would undoubtedly grow even bigger in value following the development of a new transport network.

Russell Quirk, CEO of online estate agent eMoov.co.uk commented:

The London market is currently cooling, however there are still pockets of the capital and south east which represent fantastic opportunities for property investment. Crossrail locations can expect significantly elevated increases in prices in the coming years compared to non-Crossrail areas.